We cover the articles and points below to emphasize a shift towards higher-yielding, shorter duration offerings, reiterating conclusions from our recent post, Does Fixed Income Still Provide a Hedge vs Equities?

A 60/40 Stocks/Bond Strategy Doesn’t Work. Barron’s 10/03/2020

Over the past 40 to 50 years, the 60/40 standard portfolio has done spectacularly. From 1983 to 2010, it returned 9.9% annually, with an 11.2% yearly return from the S&P and 7.0% from the Agg, both propelled by the decline in interest rates from near historic highs to historic lows.

Looking ahead is guesswork, but there’s one certainty: Returns will be lower. There could be a “Japanization” of the bond market, with yields near zero for many years. Alternatively, the future could see rising inflation and higher yields from the Fed’s massive bond purchases, which effectively “monetize” the Treasury’s multi-trillion-dollar budget deficits. It’s all unknowable, so the working assumption is that the current 1.3% yield will constitute the annual return from bonds for the next decade, Loeys wrote in a client note.

There’s No Place to Hide Anymore When the Stock Market Plunges WSJ, 10/03/2020

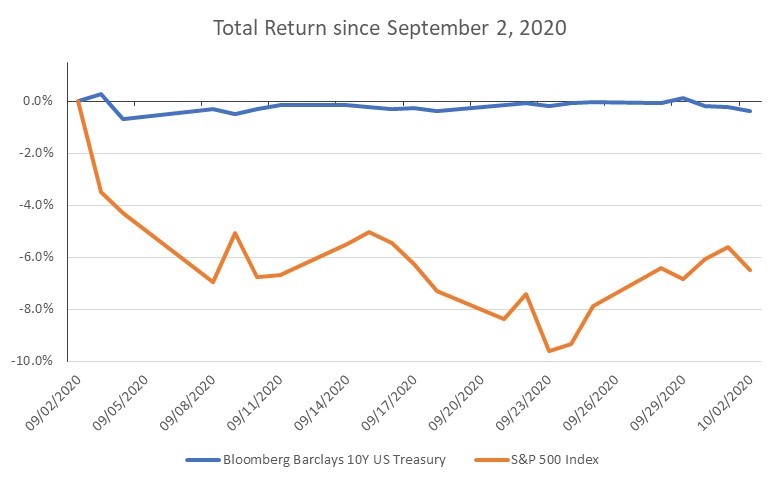

September hurt shareholders, not only because stocks fell but also because the things they’d bought to protect their portfolios also fell. From the S&P 500’s high on the 2nd of the month, stocks, Treasurys, gold, bitcoin and the VIX volatility index all dropped.

This total failure of hedging is unusual, but investors need to get used to the idea that Treasurys no longer provide the ballast for a portfolio… the biggest hedge against losses, Treasurys, probably won’t be back as a useful tool for years, if ever.

The aren’t many reasons to hold zero or negative rate securities:

Structurally, each incremental move lower in rates is more difficult than the one before. As rates approach and pass zero, it becomes harder still. With rates where they are, there simply isn’t much room for them to fall further; as a result, potential price gains from those moves are limited – approximately 7% upside to zero rates and 15% to -1% rates…not a lot of protection.

“Fixed income is now 100% fixed and 0% income,” says Jan Loeys, long-term strategist at JPMorgan. He recommends investors give up on short-term hedging entirely and focus instead on how to make gains in the long run.

How to Avoid Paying the Cruelest Tax: Inflation WSJ, 10/03/2020

If the textbooks are right this time then the worst victim of a bout of inflation would be bonds. The 10-year Treasury note, yielding just 0.7%, is already an invitation to lose money. Treasurys could fare even worse this time than in past inflationary episodes. How much investors lose, and how fast their money disappears, depends in part on the Fed.

How to Build the Best Bond Portfolio for Crazy Times Barron’s, 10/03/2020

Bonds have gone from the “sleep at night” portion of investors’ portfolios to a source of anxiety. Due to the latest shift in Federal Reserve policy, finding income in bonds has gone from being exceedingly difficult to nearly impossible, and finding safety in them might be increasingly elusive. Investors in these securities need a new approach—and a reset in expectations.

Managers say the extra income for owning longer-term bonds doesn’t amount to much, so that leaves them advocating a “barbell” approach: The best bond portfolios for today’s economic environment have one end in low-yielding, but high-quality, assets that might earn negative yields after inflation is factored in, but will act as a buffer when the market is volatile. The other end is in higher-yielding bonds, stocks, and some alternatives that can provide income.