Objective: Fund a $100 million liability in 10 years

Current Solution: Investment-Grade (IG) Corporate Debt

Alternatives: Non-Agency Mortgage-Backed Securities (MBS) and Private Credit

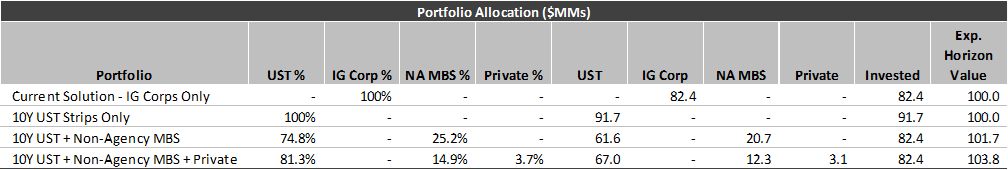

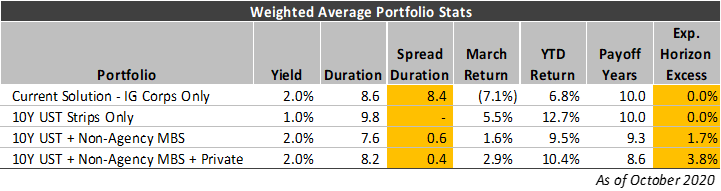

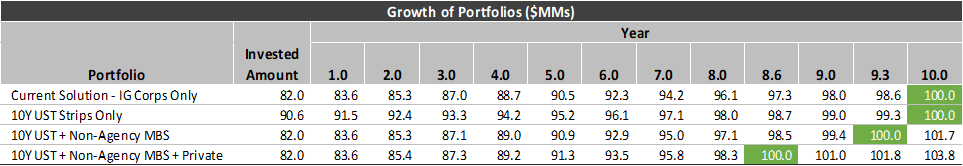

In order to meet the $100 million liability in 10 years with IG corporates, just under $82 million must be invested today. For comparison, over $90 million would be required using only 10-year US Treasuries. The alternative portfolios take their starting invested size from the IG corporate portfolio, investing in a combination of US Treasuries, Non-Agency MBS, and potentially private credit.

Because yields on Non-Agency MBS and private credit are significantly greater than IG corporates, only a fraction of risk assets are required to meet the liability.

By adding 20-25% of low duration, low credit risk Non-Agency MBS you’re able to increase your overall credit quality by allocating the remainder to US Treasuries.