The last few months have posed one of the best opportunities to trade we’ve seen in the last five years. We’re constructive in that continuing as we see more folks selling indiscriminately to chase returns elsewhere, whereas real money buyers are grasping for yield.

We get asked, “Where is the disconnect? Why don’t the buyers just show up at auction to buy bonds?” Our market is not unique in that when people want to sell, they don’t really care what bid they get. When they want to buy, they don’t care what price they pay. There will always be people that wait until they get to the beach to buy straw hats and lawn chairs.

We’d estimate that for real money accounts like PIMCO and BlackRock, they have about one person for every $10bb they’re managing. They’re incredibly understaffed and thus spend the majority of their time focused on buying new issue bonds. Once purchased, they don’t look at the bond again until they are told to sell.

After March, dealers are putting less balance sheet to work than ever before, while real money fund managers are getting inundated with inflows. This presents a unique opportunity to step in and buy cheap paper and quickly move it in less than 90 days.

Since RMBS assets amortize and pay interest monthly, there is a constant need to reinvest capital. This unique characteristic of RMBS instruments is a blessing from a risk and compounding standpoint, and a hurdle when competing with others to put money to work. We’ll happily take that, as we’re willing to work diligently to put money to work in bonds that we believe continue to produce consistently outsized returns per unit of risk.

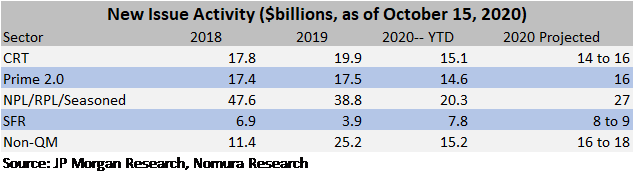

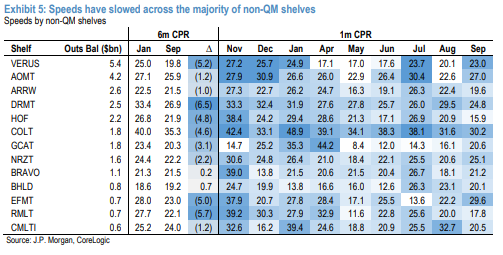

Going into year end, banks continue to print new issue deals with healthy investor appetite (see appendix for YTD and projected issuance). Prime jumbo 2.0 deals continue to prepay at high rates as prime borrowers are taking advantage of record low interest rates to refinance their loans. The issuance of new prime jumbo securitizations continues to be on pace to almost match 2019. Conversely, on the non-QM side, we have seen a steady slowdown in prepays as these borrowers have had more hurdles to overcome to refinance their loans. Though we feel the structural protection for senior bond holders in these deals is very robust, post Covid-19 originations for these loans has slowed down. The new issue sector is on pace to close with 35% less volume in 2020 than in 2019.

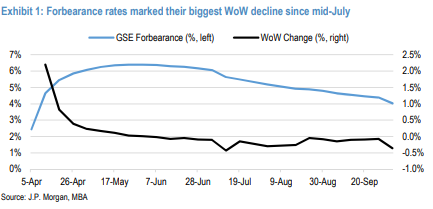

Legacy RMBS deals continue to perform well, and post Covid-19 delinquency pipelines appear to be curing for the time being. As we noted last month, we feel there are still many headwinds ahead for the broader market. With the potential of yet another wave of Covid-19 cases arising heading into winter, the upcoming election on November 3rd, and a fragile unemployment picture, we continue to invest with conservative assumptions.

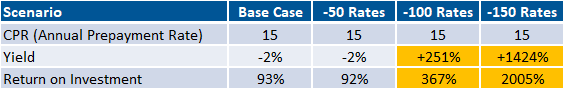

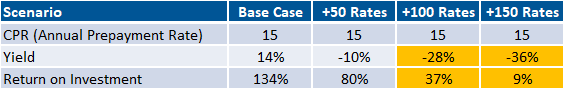

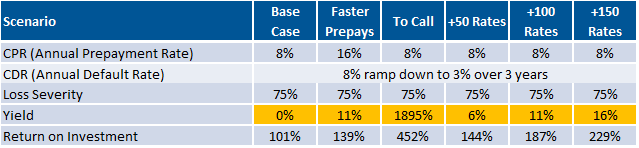

On our call we spoke of some amazing opportunities we’re seeing to both sell bonds that have appreciated wildly due to low rates, and to purchase bonds with tremendous upside to potentially higher rates. Below, we highlight a recent sale that we realized a 24x gain on as well as a purchase that has crazy upside to higher rates, faster prepayments and to potentially getting called.

Profile at Purchase: Tremendous upside to falling rates

Profile at Sale: Tremendous downside to rising rates

Regan launched its mutual fund 4 weeks ago, please visit our website or contact us for more info.

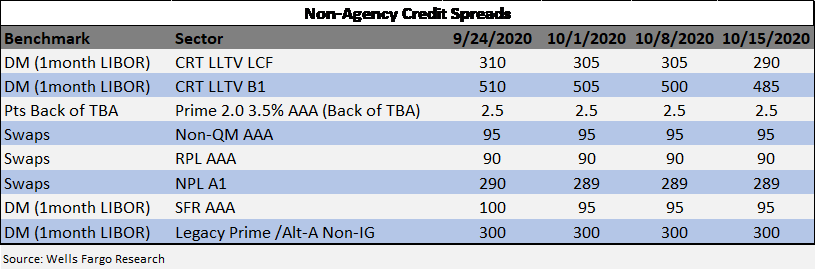

Non-Agency RMBS Performance Trends

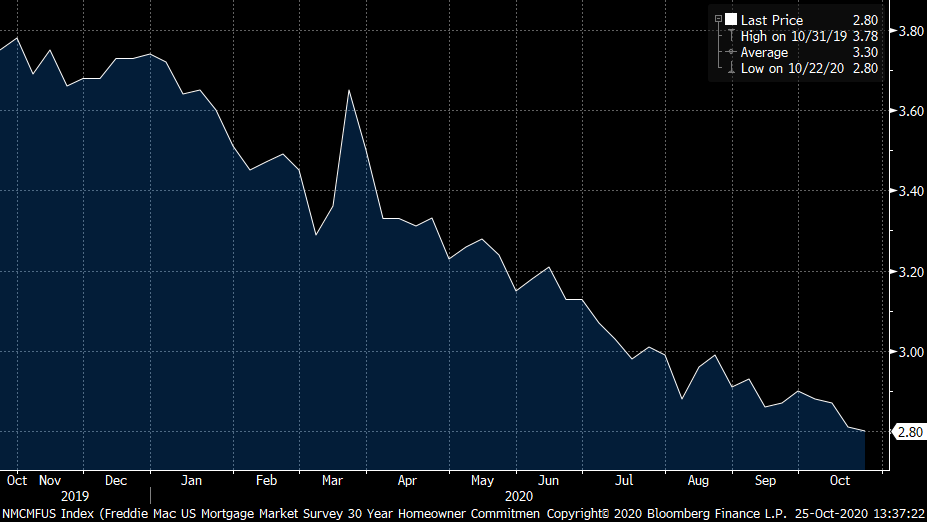

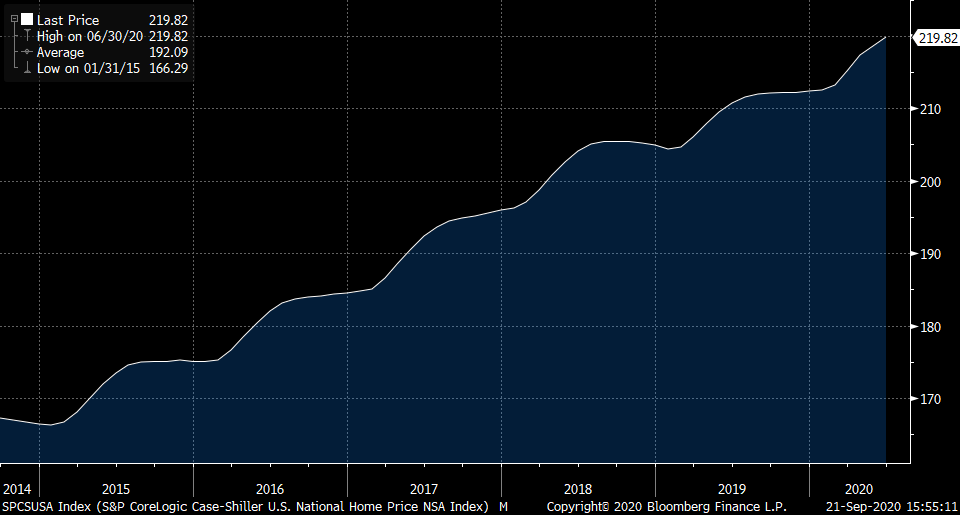

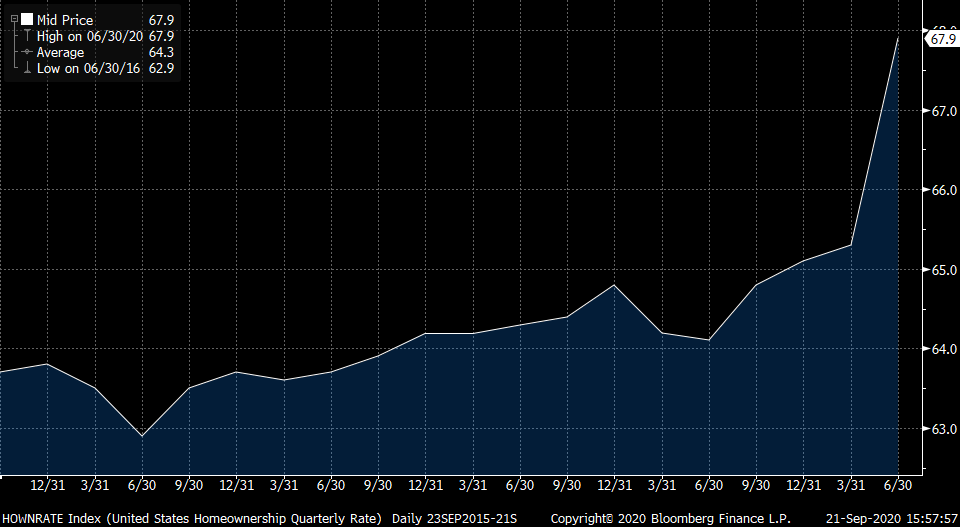

Housing activity is robust. 30-Year mortgage rates hit a new record low once again, falling to 2.80%. Home Prices and New Home Sales are both at a 10-year high. Agency mortgages continue to offer better spreads versus treasuries with similar duration. Agency mortgages currently offer +103bps of additional yield versus the US 5-year treasury bond.

30 Year-Mortgage Rates: Lowest ever, at 2.80%

US Refinancing Index: Remains elevated

US New Home Sales: At a 10-year high, up again

US Home Price Index: Home prices up again

US Home Ownership Rate: Heading Higher

Mortgage Spread vs. 5-year Treasury Yield: +103 bps